Transaction lifecycle

A transaction can be defined as an electronic message that carries information used for payment processing. Usually, transactions originate when cardholders attempt payments, with either physical or virtual debit cards at either physical stores or online.

Apto is an issuer processor: its role is to issue cards and process transactions originated from these cards.

The nature of a transaction

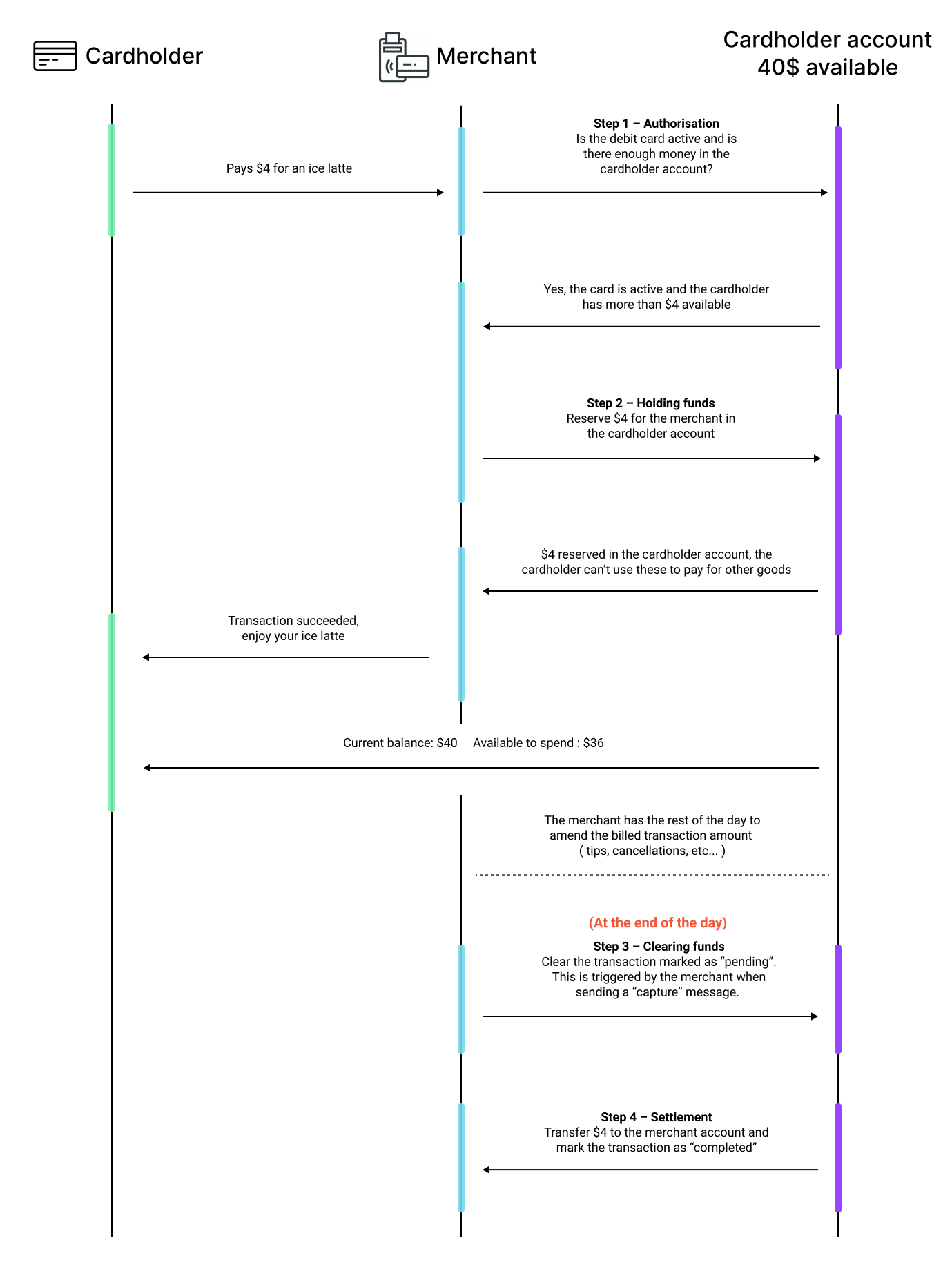

A transaction operation is composed of four steps:

- Authorization

- Holding funds

- Clearing funds

- Settlement

Step 1 (authorization) and Step 2 (holding funds) happen synchronously one after the other. However, Step 3 (clearing funds) and Step 4 (settlement) happen at a later time–as late as at the end of the day, which allows the merchant to amend the transaction amount or even cancel it.

The swipe of the card, referred to as "Authorization" (Step 1), verifies that the card is valid and there are enough funds in the cardholder account.

Funds in the cardholder account corresponding to the payment amount are put on hold, referred to as "Holding funds" (Step 2). For example if you look at any of your credit card or debit card online statements, you will see a section at the top of the screen showing "Pending Transactions". This is because the transaction hasn't officially cleared.

In most cases, a transaction is cleared the following day, but there could be other instances where it takes longer to clear. The process of finalizing the hold on funds and posting the transaction on the cardholder’s account is called "Clearing funds" (Step 3). This is triggered when the merchant sends a "capture request".

Finally, "Settlement" (Step 4) happens, which is when the funds are actually moved from the cardholder account to the merchant's bank.