Transaction states and types

info

Some of the terms used in this guide refer to the different stages of a transaction lifecycle. To better understand this guide we suggest that you look at our transaction lifecycle guide.

Transaction states

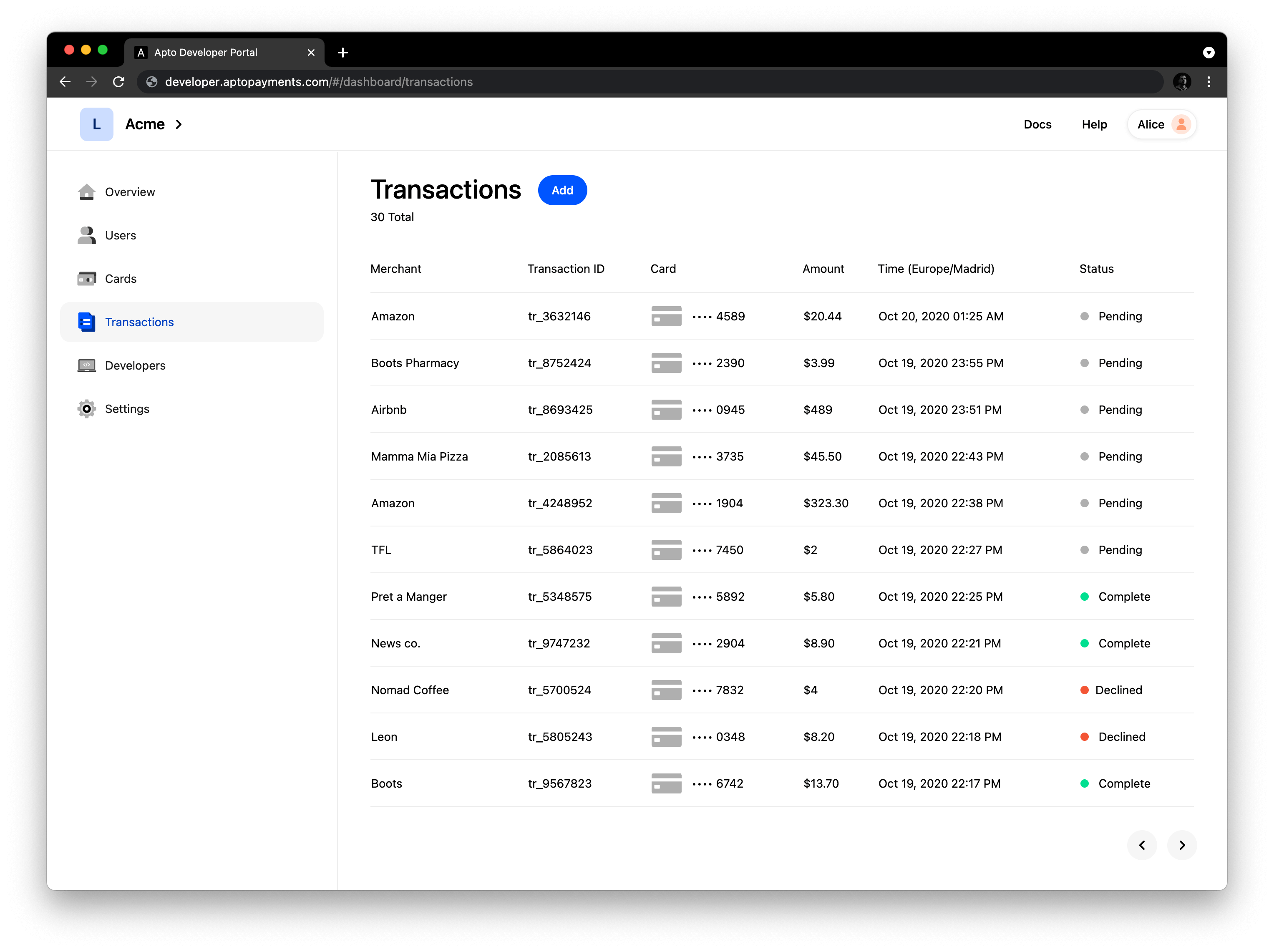

As you start to issue cards in your card program and cardholders start to make payments with them, you'll see transactions being logged in the Transactions tab in the Developer Portal (or when fetching them through our APIs):

Each transaction is represented by the state field. Here are the possible transaction states explained:

| State | Description |

|---|---|

| Pending | Indicates the transaction has been authorized and funds are on hold in the cardholder account. However, the transaction hasn't been cleared yet and the merchant can still reverse or amend the final transaction amount. Funds have not been transferred to the merchant account. |

| Complete | The transaction was authorized and funds were transferred from the cardholder account to the merchant account. The amount might differ from what was initially billed, depending on whether the merchant amended the final amount (adding tips, adjusting price, etc...). |

| Declined | Either the transaction was not authorized, because the card isn't active or there weren't enough funds on the cardholder account, or the merchant reversed the transaction after being successfully authorized. |

Transaction types

There are different types of transactions depending on their context and what is their goal.

Here are all the possible transaction types:

| Type | Description |

|---|---|

PURCHASE | The most common transaction type. Indicates the cardholder purchased a good or service in either a physical store or an online store. Such a transaction typically contains all information required for authorization and clearing in separate electronic messages. |

PIN_PURCHASE | Occurs when a cardholder makes a payment using their PIN. Such a transaction typically contains all the information required for authorization and clearing in a single electronic message. |

PENDING | Generally, this state is when a transaction has been authorized and not yet completed. |

DECLINE | Transactions that are not authorized for any reason. The most common is not sufficient funds. |

REVERSAL | These transactions occur after the authorization has succeeded but before clearing and settlement have taken place. At this point, the merchant can cancel the transaction without having to refund the cardholder, as the funds haven't moved yet. |

REFUND | Indicates an amount previously spent that should be returned to the cardholder. Unlike reversal, this happens when funds have already been moved to the merchant account but the cardholder asks for a refund (i.e., when returning a product). |

WITHDRAWAL | Indicates the cardholder intends to withdraw some money from their account. Usually at an ATM in a physical location. |

BALANCE_INQUIRY | Cardholder checks their account balance at an ATM. |

DEBIT | Debit operation on the card, which can occur on bill payments or loading another payment source with the card. |

CREDIT | Indicates an amount that should be transferred to another payment source, for instance when adding funds to a prepaid card. |

NON_FINANCIAL | Operations not related to funds movement like changing the card PIN on an ATM. |