How to fund your account

Types of Accounts

When you activate your card program with Apto, two bank accounts are set up for your program:

- Developer Account - Funds for you to add to cardholder accounts.

- Reserve Account - Apto requires $5,000 in a reserve account to cover losses or fund shortages due to fraud, reversals, refunds, load failure, disputes, negative balances, or other payment adjustments made by the network or Apto.

To activate your card program, you may have to first load funds to your developer account, followed by loading funds to single or multiple cards.

Note - certain customers may have a different funding model, please work with your Program Support team as needed.

Funding your Developer Account

You can load funds into your Developer Funding Account and individually push those funds to your cardholder's accounts. This will enable your cardholders to start using your physical and/or virtual cards right away. You can load funds to your developer account via ACH or Wire.

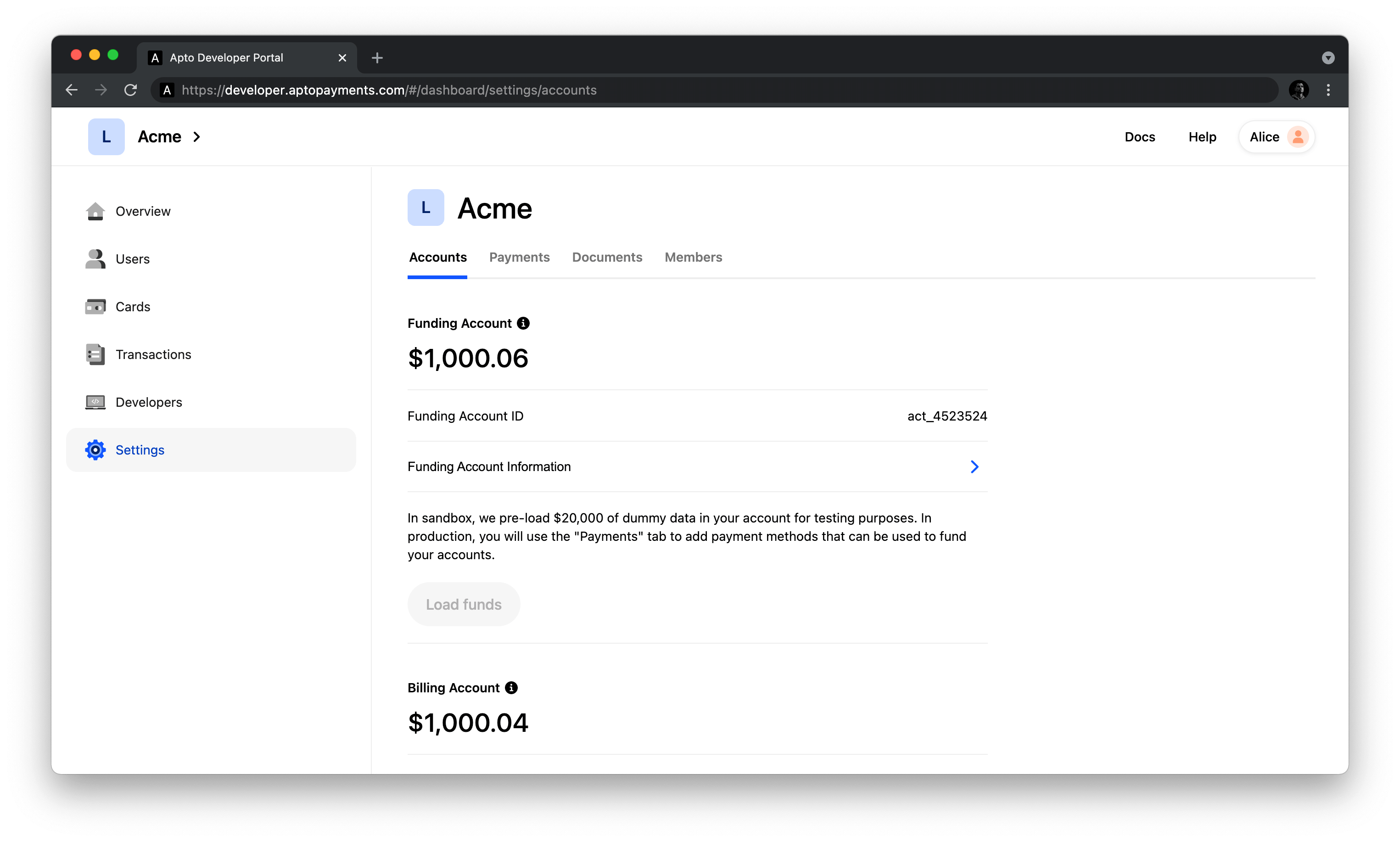

To view details about your Developer Funding Account, navigate to Settings > Accounts in the developer portal.

Load Funds via ACH

Within the Developer Portal, we support ACH payments to add funds to your Developer Funding Account. Follow these steps to fund your account:

- Log in to the Developer Dashboard

- Navigate to Settings > Account

- Click on the arrow for “Developer Funding Account Information”

- This displays your program's ACH account information which can receive funds

Next, link your external bank account to Apto's Developer Funding Account:

- Navigate to your external financial institution's account details page

- Link your Apto ACH account to your external financial institution

- Begin triggering micro deposits to your Apto Developer Account for external account validation

You should receive these micro deposits within 24-48 hours. You can log in to the Developer Portal and check the Transactions tab to confirm.

To manage your developer funding account, navigate to Settings > Accounts in the developer portal.

Funding Cards

We have multiple options for Customers and Cardholders to load funds to individual cards:

| Method | Description | Fees | |

|---|---|---|---|

| Direct deposit - ACH | An external party submits an ACH Direct Deposit to the card's virtual account - this information can be retrieved via the Retrieve a Card API > Features. | No fees to Apto Customers or cardholders | |

| Cash Loading | Deposit cash at a retail location via the Mastercard rePower Network | User pays a fee at the register, determined by the retailer. No fee from Apto | |

| Instant Debit Card Loading (pull) - AFT | Instant Debit Card Loading via Mastercard Send or Visa Direct | Additional fee to Apto Customer or cardholder | |

| Instant Debit Card Loading (push) - OCT | Instant Debit Card Loading via Mastercard Send or Visa Direct | No fee. The cardholder may be charged a fee from the external party. Example: Venmo | |

| Mobile Check Deposit | Via the Ingo money app. Take a photo of the check, Ingo approves, and the money is pushed to the card via the rePower functionality | 1-3% charged by Ingo directly to the cardholder. No fee from Apto | |

| Account to Account | Once you have loaded funds to your Developer Account, you can transfer funds to a cardholder's card from that account, using the Developer Portal (Cards > Load Funds) | No fee |

Funding multiple cards

At this time, we do not support the ability to fund multiple cards in your card program with a single operation via the Developer Portal or Mobile API.

We do support this ability via the Core API, which requires an additional level of access. Once you have access to this endpoint, you'll first need to programmatically retrieve all cards in your card program and then push the funds amount you want to each of them.

- Call the list cardholders endpoint and get all the card IDs by reading

cards > card > idfrom the response.

curl --location --request GET 'https://api.aptopayments.com/cardholders' \

--header 'Authorization: Basic {CORE_API_KEY}'

- For each card ID found send a

POSTrequest to the load funds endpoint specifying the amount you want to load on the card:

curl --location --request POST 'https://api.aptopayments.com/cards/{card_id}/load_funds' \

--header 'Authorization: Basic {CORE_API_KEY}' \

--header 'Content-Type: application/json'

--data-raw '{

"amount": {

"currency": "USD",

"amount": 500

},

"idempotency_key": "abcd1234",

"description": "Credit $50",

"source_balance_id": "bal_0e9b7821d837542e"

}'

You'll need to use your Developer Funding Account ID as the source_balance_id. You can see your Developer Funding Account ID in the Developer Funding Account section within the Settings > Accounts page.

Interchange Earnings

As a customer of Apto, your program earns revenue from interchange every time a transaction occurs. Detailed information about your interchange earnings is available on your Apto invoice.

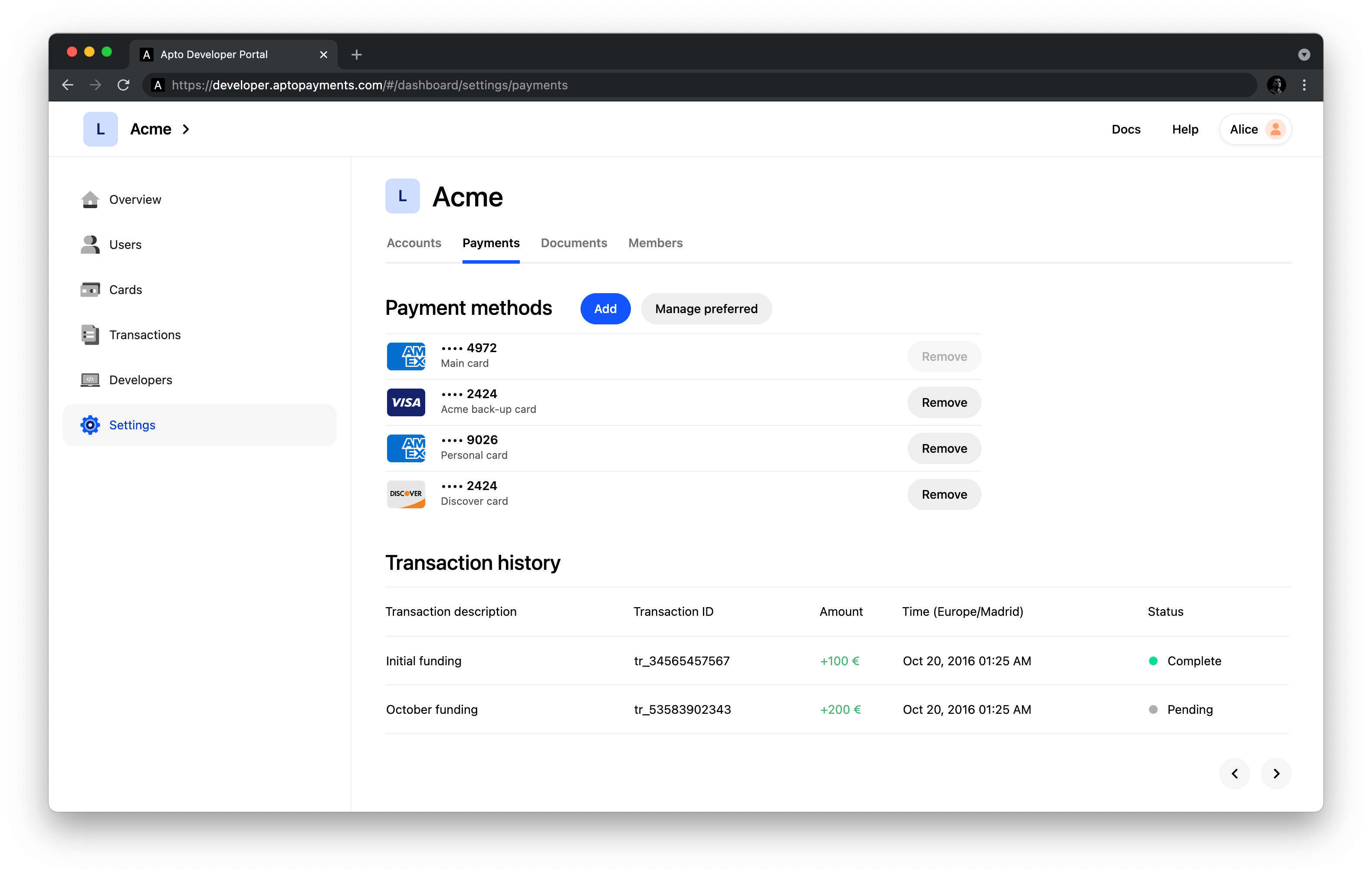

Transaction history

All transactions that occur on the Developer Funding Account and Reserve Account are available to view in the Transaction history section within the Settings > Transactions page.